Динамика + 60

реклама

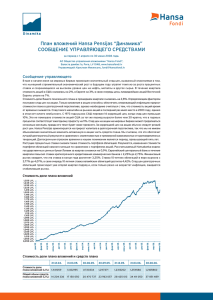

30 ˲Ìfl 2008 „. èÂÌÒËÓÌÌ˚È ÔÎ‡Ì “ÑË̇ÏË͇ + 60” ëÚÂÔÂ̸ ËÒ͇ àÌ‚ÂÒÚˈËÓÌÌ˚ ÔË̈ËÔ˚ àÌ‚ÂÒÚˈËÓÌ̇fl ÔÓÎËÚË͇ è·̇ fl‚ÎflÂÚÒfl Ò·‡Î‡ÌÒËÓ‚‡ÌÌÓÈ, ÔÓÒÍÓθÍÛ Ò‰ÒÚ‚‡ è·̇ ‚Í·‰˚‚‡˛ÚÒfl ‚ ‡ÍˆËË (30% - 60%) Ë ÙË̇ÌÒÓ‚˚ ËÌÒÚÛÏÂÌÚ˚ Ò ÙËÍÒËÓ‚‡ÌÌ˚Ï ‰ÓıÓ‰ÓÏ. LJβڇ Ô·̇ – ‚Ó. ÙÓ̉˚ ‡ÍˆËÈ Òϯ‡ÌÌ˚ ÙÓ̉˚ ÙÓ̉˚ Ó·ÎË„‡ˆËÈ ËÒÍ é·˘Ë ‰‡ÌÌ˚ ÅÓθ¯ÂÈ ÓÊˉ‡ÂÏÓÈ ‰ÓıÓ‰ÌÓÒÚË ÒÓÔÛÚÒÚ‚ÛÂÚ ·ÓΠ‚˚ÒÓÍËÈ ËÒÍ. ìÔ‡‚Îfl˛˘‡fl ÍÓÏÔ‡ÌËfl êÛÍÓ‚Ó‰ËÚÂθ Ô·̇ ÉÓ‰ ÓÒÌÓ‚‡ÌËfl á‡fl‚ÎÂÌËfl ÔËÌËχ˛ÚÒfl AS IPS Hansa Fondi äËÒÚË‡Ì åËÍÂθÒÓÌÒ 2003 ‚ ÙËΡ·ı Aé “Hansabanka” AO “Hansa atklÇtais pensiju fonds” ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ëÚÓËÏÓÒÚ¸ ‡ÍÚË‚Ó‚ Ô·̇ è·ڇ Á‡ ÛÔ‡‚ÎÂÌË EUR 1,2564117 EUR 5 762 844 1,25% ëÚÛÍÚÛ‡ ÔÓÚÙÂÎfl Ä͈ËË é·ÎË„‡ˆËË ÑÂÌÂÊÌ˚ Ò‰ÒÚ‚‡ ÑË̇ÏË͇ ÒÚÓËÏÓÒÚË ‰ÓÎË Ô·̇ êÓÒÒËfl Ö‚ÓÔ‡**** ÑÛ„‡fl ӷ·ÒÚ¸ ã‡Ú‚Ëfl ëòÄ ÇÓÒÚӘ̇fl Ö‚ÓÔ‡ üÔÓÌËfl 1,40 1,30 1,20 1,10 èËÓÒÚ**, % ÑÓıÓ‰ÌÓÒÚ¸***, % 50,4% 38,7% 10,9% ëÚÛÍÚÛ‡ ÔÓÚÙÂÎfl ÔÓ ÒÚ‡Ì‡Ï 1,50 1,00 2003 50,4% 38,7% 10,9% 3,8% 39,5% 20,8% 10,9% 12,0% 10,2% 2,8% 3,8% 39,5% 20,8% 10,9% 12,0% 10,2% 2,8% **** - ÍÓÏ ÇÓÒÚÓ˜ÌÓÈ Ö‚ÓÔ˚ 2004 2005 2006 2007 Ò Ì‡˜‡Î‡ „Ó‰‡ 1 ÏÂÒflˆ 3 ÏÂÒflˆ‡ 6 ÏÂÒflˆ‡ 1 „Ó‰ 2 „Ó‰‡ Ò ÒÓÁ‰‡ÌËfl* -10,57% -4,69% -0,53% -10,54% -11,60% -11,57% 4,58% 2,26% 26,41% 4,88% * - cÓ ‰Ìfl ÓÒÌÓ‚‡ÌËfl ** - ‰ÓıÓ‰ÌÓÒÚ¸ Ë ÔËÓÒÚ ‡Òc˜ËÚ‡Ì˚ ‰Ó ‡‰ÏËÌ. ÍÓÏËÒÒËË ÓÚÍ˚ÚÓ„Ó ÔÂÌÒËÓÌÌÓ„Ó ÙÓ̉‡ Hansa *** - „Ó‰Ó‚‡fl ÔÓˆÂÌÚ̇fl ÒÚ‡‚͇ ‰ÓıÓ‰ÌÓÒÚË ‡ÒÒ˜Ëڇ̇, ËÒÔÓθÁÛfl Äëí/365 ÏÂÚÓ‰ Ieguld¥jumu sadal¥jums pa valtÇm GBP EUR USD***** JPY 5,0% 72,8% 19,3% 2,9% 5,0% 72,8% 19,3% 2,9% ***** - ÔÂʉ forward ÑÓıÓ‰ÌÓÒÚ¸, % 2004 2005 2006 2007 5,62% 15,42% 9,68% 3,80% äÓÏÏÂÌÚ‡ËÈ ç‡ ÏËÓ‚˚ı ·Ëʇı ‚ ̇˜‡Î „Ó‰‡ ÍÛÔÌÂȯÂÈ ÔÓ·ÎÂÏÓÈ ·˚ÎË ÌÂÓÊˉ‡ÌÌÓ ÍÛÔÌ˚ ۷˚ÚÍË ·‡ÌÍÓ‚ ëòÄ, ‡ Ú‡ÍÊ ‰Û„Ëı ·‡ÌÍÓ‚, Á‡‚flÁ‡ÌÌ˚ı ̇ ˚ÌÓÍ ‡ÏÂË͇ÌÒÍËı ËÔÓÚ˜Ì˚ı ·Ûχ„ ‚˚ÒÓÍÓ„Ó ËÒ͇. èÓÒΠ‚˚fl‚ÎÂÌËfl ÍÛ„‡ ÔÓ·ÎÂÏ Í ‚Í·‰˜ËÍ‡Ï ‚ÂÌÛ·Ҹ ÔÓÎÓÊËÚÂθ̇fl Û‚ÂÂÌÌÓÒÚ¸ ‚ ‰Ó΄ÓÒÓ˜ÌÓÏ ÓÒÚÂ, Ë Ì‡˜‡ÎÒfl ÒÚÂÏËÚÂθÌ˚È ÔÓ‰˙ÂÏ ˆÂÌ Ì‡ ‡ÍˆËË Ì‡ ÔÓÚflÊÂÌËË ‰‚Ûı ÏÂÒflˆÂ‚ Ò Ï‡Ú‡ ÔÓ Ï‡È, ÍÓ„‰‡ Ë̉ÂÍÒ ˆÂÌ Ì‡ ‡ÍˆËË MSCI World ‚ ‚‡Î˛ÚÂ Â‚Ó ‚ÓÁÓÒ Ì‡ 15%. ùÚÓÚ ÓÒÚ ˆÂÌ Ì‡ ‡ÍˆËË ËÒÒflÍ Ò ÂÁÍËÏ ÔÓ‚˚¯ÂÌËÂÏ ˆÂÌ Ì‡ ÌÂÙÚ¸, ‚Ó 2-Ï Í‚‡Ú‡Î ÔÓ‰Ìfl‚¯ËıÒfl ̇ 38%, ‡ Á‡ ÔÓÒΉÌË ÚË „Ó‰‡ ÛÚÓË‚¯ËıÒfl. ÇÒΉ Á‡ ÔÓ‰ÓÓʇÌËÂÏ ÚÓÔÎË‚‡ ÔÓ¯ÎË ‚‚Âı ˆÂÌ˚ ̇ ÔÓ‰Ó‚ÓθÒÚ‚ËÂ, Ë ˝ÚÓ ÛÏÂ̸¯ËÎÓ ‚ÓÁÏÓÊÌ˚ ‡ÒıÓ‰˚ ÔÓÚ·ËÚÂÎÂÈ Ì‡ ‰Û„Ë ÌÛʉ˚. ëÌËÊÂÌË ÒÔÓÒ‡ ̇ ÚÓ‚‡˚ ÔÓ‚ÎÂÍÎÓ Á‡ ÒÓ·ÓÈ ÛÏÂ̸¯ÂÌË ÔË·˚ÎË ÍÓÏÔ‡ÌËÈ ‚ ˝ÚÓÏ „Ó‰Û Ë ˆÂÌ Ì‡ ‡ÍˆËË. ë Ò‰ËÌ˚ χfl ‰Ó Ò‰ËÌ˚ ˲Îfl ˆÂÌ˚ ̇ ‡ÍˆËË ÒÌËÁËÎËÒ¸ ̇ 17%, ‚ÂÌÛ‚¯ËÒ¸ Í Ï‡ÚÓ‚ÒÍÓÏÛ ÛÓ‚Ì˛. ç‡ ˚Ì͇ı Ó·ÎË„‡ˆËÈ ËÌÙÎflˆËÓÌÌ˚ ÓÔ‡ÒÂÌËfl ‚˚Á‚‡ÎË ÒÌËÊÂÌË ˆÂÌ Ì‡ Ó·ÎË„‡ˆËË, ˜ÚÓ Ì ÔÓÁ‚ÓÎËÎÓ ‰ÓÒÚ‡ÚÓ˜ÌÓ ÍÓÏÔÂÌÒËÓ‚‡Ú¸ ÒÔ‡‰ ˆÂÌ Ì‡ ‡ÍˆËË. ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ‚ ˝ÚÓÏ Í‚‡Ú‡Î ÒÌËÁË·Ҹ ̇ 0,53%. å˚ ˜‡ÒÚ˘ÌÓ ËÁÏÂÌËÎË ‚Íβ˜ÂÌÌ˚ ‚ ÔÓÚÙÂθ Ô·̇ ÙÓ̉˚ ‡ÍˆËÈ, ҉·‚ ·Óθ¯ËÈ ÛÔÓ Ì‡ ÙÓ̉˚ Ò ‡ÍÚË‚ÌÓÈ ÔÓÎËÚËÍÓÈ ‚˚·Ó‡ ‡ÍˆËÈ Ë ÒÓ͇ÚË‚ Û‰ÂθÌ˚È ‚ˉ Ë̉ÂÍÒÓ‚ ‡ÍˆËÈ. ÅÓθ¯‡fl ˜‡ÒÚ¸ ÔÓÚÙÂÎfl ÔÓ-ÔÂÊÌÂÏÛ ‚ÎÓÊÂ̇ ‚ ‡Á‚ËÚ˚ ˚ÌÍË ‡ÍˆËÈ Ò ˆÂθ˛ ÛÏÂ̸¯ÂÌËfl ËÒ͇ ˚Ì͇ ‡ÍˆËÈ. Ç ÔÓÚÙÂΠӷÎË„‡ˆËÈ Ï˚ ÔÓ‰‰ÂÊË‚‡ÂÏ ÌËÁÍËÈ Û‰ÂθÌ˚È ‚ÂÒ Í‰ËÚÌÓ„Ó ËÒ͇ Ë ÌËÁÍËÈ Û‰ÂθÌ˚È ‚ÂÒ ‰Ó΄ÓÒÓ˜Ì˚ı Ó·ÎË„‡ˆËÈ. äÛÔÌ˚ ËÌ‚ÂÒÚˈËË àÌ‚ÂÒÚˈËfl ÑÓÎfl Pimco îÓ̉ ‚ÓÓ·ÎË„‡ˆËÈ SSGA Europe îÓ̉ ‡ÍˆËÈ SSGA USA îÓ̉ ‡ÍˆËÈ BlueBay Investment Grade îÓ̉ Ó·ÎË„‡ˆËÈ Aviva ÙÓ̉ Ö‚ÓÔÂÈÒÍËı ‡ÍˆËÈ ÍÓ̂„Â̈ËË T.Rowe Price îÓ̉ ÍÓÔÓ‡ÚË‚Ì˚ı ‚ÓÓ·ÎË„‡ˆËÈ GAM Global îÓ̉ ‡ÍˆËÈ SPDR Trust S&P500 îÓ̉ ‡ÍˆËÈ Hansa îÓ̉ ÇÓÒÚÓ˜ÌÓ-Ö‚ÓÔÂÈÒÍËı Ó·ÎË„‡ˆËÈ streetTRACKS MSCI ÙÓ̉ Ö‚ÓÔÂÈÒÍËı ‡ÍˆËÈ 8,4% 7,8% 7,5% 6,8% 6,1% 5,3% 5,0% 4,5% 4,1% 3,8%