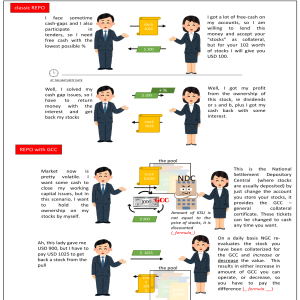

Trade Stocks and Commodities With the Insiders - Secrets of the COT Report

реклама