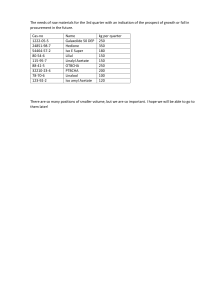

Swing Trading Checklist 1. Are we in a risk on or off environment? a. What are the factors for the risk? b. Is the risks a company risk, industry, or sector risk? c. Is the risk a macroeconomic risk? d. Is it a social/global risk? e. Is there a risk in the process? 2. What is the VIX now compared to the previous week? 3. What is the narrative for this sector? 4. Where is the Nasdaq and S&P (are we near any support or resistance levels) 5. What is the stock’s Beta? 6. What is the level on the Fear and Greed Index? 7. What are the technical levels on the stock? a. Where’s the Support and Resistance on the Weekly & Monthly chart? b. What happened the last few times it touched those levels? c. What was the volume that day vs average? 8. What is moat for investors to buy? a. Is this a real investment opportunity or a gamble? b. Will buyers hold through the quarter and why? 9. How has their P/E ratio changed over the quarter? 10. How fast was price accelerating or declining recently? 11. What were institutional investors positioned the previous quarter (13F filings) 12. How are the gamma on the options chain for in the money (barchart history) 13. What was the most recent analyst price targets? a. When were the last targets? b. By whom was the targets and what is their track record? 14. How’s the stock trading vs the rest of the sector? 15. How’s the stock trading vs the industry and overall market? 16. How has it trade on a risk off environment? 17. How has it traded on a risk on environment? 18. What was its biggest 1-day drawdown? a. Why? b. How long did it take to recover? 19. What are the OI on the stock? 20. What is the IV on the options chain?